Self-Employed Tax Receipts Checklist: Get Organized

For self-employed individuals and freelancers, managing tax receipts can feel overwhelming. However, a structured approach to expense tracking transforms this annual task into a manageable process. Proper receipt hygiene ensures accurate deductions, maintains compliance, and provides peace of mind.

This guide shares practical steps for keeping your financial records complete, easily searchable, and exportable for tax time. Mastering these habits will save you hours, maximize eligible deductions, and simplify your financial life. Let’s explore how to organize your business receipts effectively.

What is the Essential Tax Receipt Checklist for Self-Employed?

Direct Answer: Capture. Categorize. Backup. Record merchant/date/amount immediately, add a note for context, store digitally, and export monthly. This routine transforms tax season from chaotic to calm.

Staying organized starts with understanding what information is crucial and how to manage it. This checklist covers the fundamental steps to ensure your receipts are always tax-ready.

What Key Details Must You Capture on Every Receipt?

Direct Answer: The Big 4: Merchant, Date, Amount, and Tax/VAT. Without these, a receipt is just paper. Ensure it’s legible to make your deduction audit-proof.

Every business transaction, no matter its size, holds potential tax implications. Missing key information can turn a valid deduction into a disallowed expense.

- Merchant Name: Clearly identify who you paid. This is fundamental for verification by tax authorities.

- Date of Purchase: The transaction date is critical for accurate financial reporting. It ensures expenses are associated with the correct tax year.

- Total Amount: Record the full cost of the item or service, including any applicable taxes.

- Tax/VAT Details: If applicable, ensure the tax breakdown (e.g., VAT, sales tax) is visible. This can be vital for reclaiming certain taxes or for specific accounting methods.

- Proof of Purchase: A receipt is official documentation. Ensure it looks legitimate and contains all necessary details. From our experience, a credit card statement often only shows the total, not the detailed breakdown of the purchase itself; always prioritize the itemized receipt.

How Should You Categorize and Add Notes to Receipts?

Direct Answer: Context is King. Link expense to a category (e.g., “Travel”) and add a “Why” note (e.g., “Client Pitch in NY”). This 5-second habit saves hours of explaining during an audit.

A pile of receipts, even with all details captured, remains just a pile without proper organization. Intelligent categorization and contextualization are crucial for clarity.

- Add a Category: Assign each receipt to a specific expense category relevant to your business. Examples include Office Supplies, Software Subscriptions, Travel, Professional Development, or Meals & Entertainment. Consistent categorization makes it easy to run reports and quickly identify where your money is going.

- Include a Short Note (Client/Project/Purpose): Why did you make this purchase? Was it for a specific client project? A business trip? A software upgrade? A brief, descriptive note provides invaluable context. This is especially helpful if auditors question an expense years down the line. For example, “Client meeting - Project X” or “New laptop for design work.” This step is crucial for justifying self-employed deductions receipts.

Why is Digital Record-Keeping Crucial for Tax Receipts?

Direct Answer: They last forever. Digital receipts don’t fade, tear, or get lost. They are searchable, secure, and legally accepted by most tax authorities, unlike their fragile paper ancestors.

The days of shoeboxes full of paper receipts are (thankfully) behind us. Digital copies offer numerous advantages that benefit both you and your accountant.

- Keep Digital Copies of Important Receipts: Scan or photograph every significant business receipt. Modern scanning apps, often built into accounting software like Portmoneo, can capture details quickly and store them securely.

- Benefits of Digital:

- Durability: Digital files don’t fade, tear, or get lost in a house fire.

- Searchability: Easily find specific receipts by date, merchant, category, or notes.

- Space-Saving: Eliminate physical clutter entirely.

- Accessibility: Access your receipts from anywhere, on any device.

- Legal Acceptance: In many countries, digital copies of receipts are legally accepted for tax purposes. They must be legible and accurately reflect the original transaction. Always check your local tax authority’s guidelines.

How Often Should You Export and Back Up Your Receipt Data?

Direct Answer: Monthly. Don’t wait. Export specific CSVs for data and PDFs for proof. Store backups on a separate drive or cloud. Redundancy is your safety net against data loss.

Even the best digital system needs a robust backup plan. Regular exports protect your data and simplify sharing information, especially when preparing receipts for accountant submissions.

- Choose Appropriate Formats: Export data in formats useful for your needs and your accountant’s. CSV files are excellent for data manipulation, while PDF exports of individual receipts or reports provide visual proof.

- Redundancy is Key: Store backups in a separate location from your primary data (e.g., a cloud drive, an external hard drive). This is a critical step for providing complete receipts for accountant queries. We’ve seen clients avoid significant headaches by consistently backing up their data this way.

Why Must You Separate Personal and Business Finances?

Direct Answer: To avoid audit nightmares. Mixing funds creates a “piercing the corporate veil” risk. Dedicated accounts create a clean, defensible audit trail that auditors respect.

One of the most common pitfalls for self-employed individuals is mixing personal and business expenses. This leads to confusion, difficulty in tracking deductions, and red flags during an audit.

- Separate Personal vs. Business Spending: Ideally, use dedicated bank accounts and credit cards solely for business transactions. This creates a clear audit trail and makes it infinitely easier to reconcile your finances.

- Avoid Commingling: Even if you pay for a business expense with a personal card, ensure it’s immediately recorded and properly categorized as a business expense that needs reimbursement or adjustment. Conversely, do not use business funds for personal purchases. Our analyses of common audit triggers consistently highlight commingling as a major issue.

What Are Key Considerations for Self-Employed Tax Deductions?

Direct Answer: Know the rules. Legitimate expenses reduce tax but require proof. Track core categories (Supplies, Software, Travel) and keep records for 3-7 years to stay compliant.

Understanding what you can deduct is as important as properly documenting it. This section delves into common questions surrounding self-employed deductions receipts.

What Receipts Should You Absolutely Keep?

Direct Answer: If it costs money to run your business, keep it. Office supplies, software, travel, meals. Even small receipts add up to big deductions. When in doubt, save it.

The general rule of thumb is: if it’s a legitimate business expense, keep the receipt. Here are some common categories of deductible expenses for self-employed individuals:

- Office Supplies and Equipment: Pens, paper, printer ink, laptops, monitors, office furniture.

- Software and Subscriptions: Any software (e.g., accounting, design, project management), cloud services, or online subscriptions essential for your work.

- Professional Development: Courses, workshops, conferences, books, and industry memberships related to improving your business skills.

- Travel and Mileage: Flights, accommodation, public transport, and mileage for business-related travel. Maintain detailed mileage logs if deducting vehicle expenses.

- Home Office Expenses: A portion of rent/mortgage, utilities, internet, and insurance if you use a dedicated space in your home regularly and exclusively for business.

- Meals and Entertainment: Often partially deductible, particularly if directly related to business discussions or client meetings. Always note the business purpose.

- Marketing and Advertising: Website costs, social media ads, business cards, networking event fees.

- Insurance: Business liability, professional indemnity, or health insurance premiums (depending on local tax laws).

- Professional Services: Fees paid to accountants, lawyers, business consultants.

How Long Must You Retain Your Receipts?

Direct Answer: 3 to 7 Years. Rules vary by country (IRS is typically 3 years). Keep asset records longer. Consult your local authority, but hoarding digital copies permanently is the safest bet.

This is a crucial question, and the answer varies significantly by country and even by the type of expense.

- General Guidance: Many tax authorities recommend keeping records for at least 3 to 7 years from the date the tax return was filed. For example, the IRS generally advises keeping records for three years from the date you filed your original return or two years from the date you paid the tax, whichever is later, if you claim a credit or deduction IRS Publication 583.

- Specific Situations: For assets, property, or certain long-term investments, the retention period might be longer. If you incur a loss or have unusual transactions, keeping records for even longer can be beneficial.

- Consult Your Accountant: The most accurate guidance will come from your local tax authority or, more practically, your accountant. They can provide advice specific to your business structure and jurisdiction, ensuring you comply with all local regulations.

What are the Benefits of Organized Receipts for Your Accountant?

Direct Answer: Speed and Accuracy. Organized records mean your accountant spends time on strategy, not data entry. It lowers their fees, reduces questions, and ensures accurate filings.

Your relationship with your accountant can be significantly improved by providing them with well-organized, complete financial data. When you manage your receipts for accountant submissions proactively, everyone benefits.

- Streamlined Process: An accountant can process organized data far more quickly than a disorganized pile. This translates to less time spent on their part, which can often mean lower accounting fees for you.

- Fewer Queries: When all details are clear, categorized, and supported by notes, your accountant will have fewer questions, reducing back-and-forth communication. In our experience, clients with meticulous records save significant time during tax prep.

- Accurate Filing: Properly managed receipts ensure that every eligible deduction is claimed accurately, minimizing the risk of errors or missed opportunities.

- Better Advice: With clear financial insights, your accountant can offer more strategic tax planning advice throughout the year. This is far more valuable than just reacting at tax time. Tools that allow for easy export, like Portmoneo, are invaluable in this regard.

What Common Receipt Management Mistakes Should Self-Employed Avoid?

Direct Answer: Don’t wait. Procrastination leads to lost receipts and faded ink. Avoid vague descriptions and single-point failures. Use digital tools to automate the discipline.

Even with the best intentions, it’s easy to fall into traps that complicate receipt management. Avoiding these common errors will save you time and money.

- Procrastination: Waiting until the last minute to sort receipts is a recipe for stress and missed deductions. Adopt a “do it now” mentality for capturing and categorizing expenses.

- Losing Small Receipts: Often, the smallest expenses (a coffee during a client meeting, a parking fee) are overlooked or lost. These seemingly minor costs add up to significant deductions over a year.

- Unclear Descriptions: Just saving a receipt without a category or descriptive note makes it almost useless for recalling its purpose later. We’ve observed this leads to many missed deductions.

- Reliance on a Single System: Whether it’s a physical folder or a single cloud service, relying on one point of failure for your records is risky. Implement robust backup strategies.

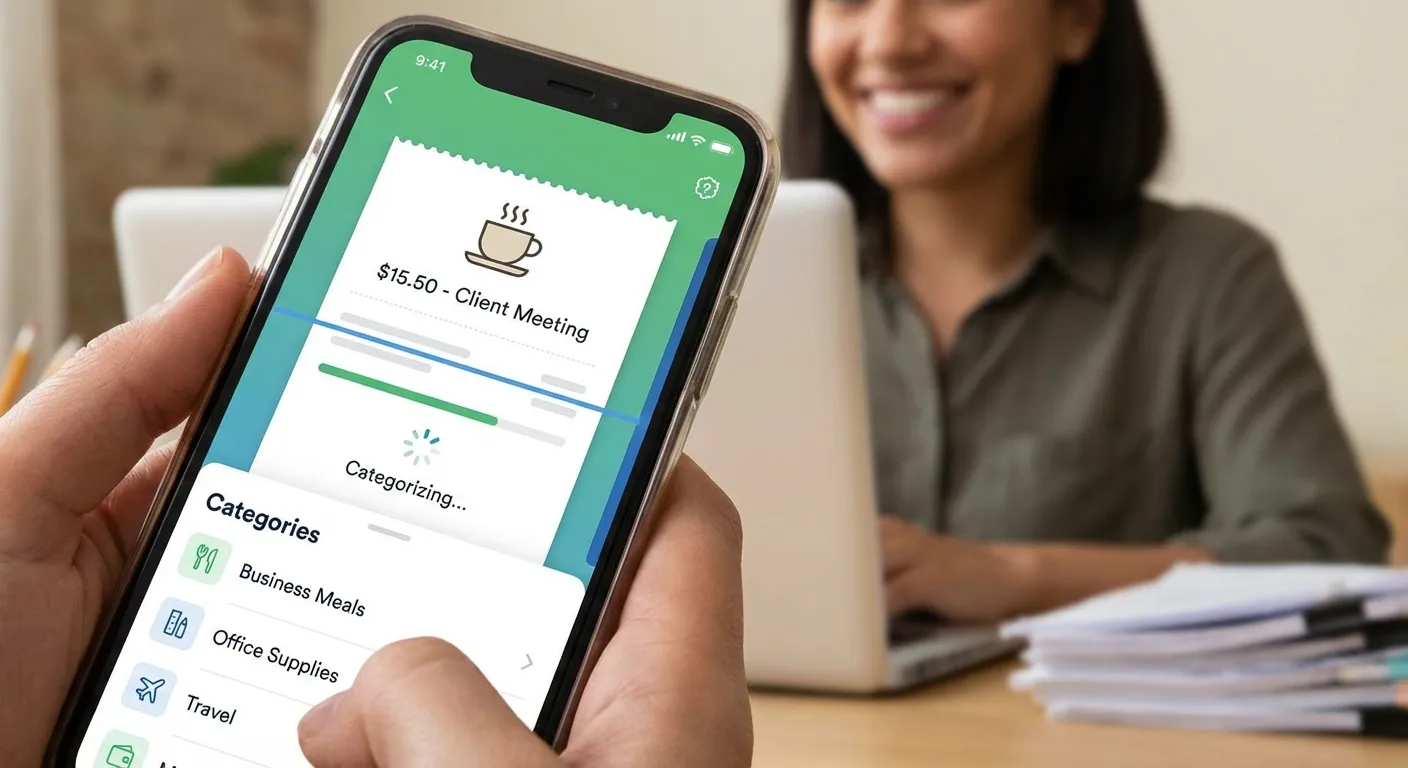

- Ignoring Digital Tools: Modern apps and software are designed to simplify this process with features like OCR scanning and AI categorization. Not utilizing them means working harder, not smarter.

Simplify Your Expense Tracking with Portmoneo

Managing receipts doesn’t have to be a chore. With the right system, it can become a seamless part of your business operations, saving you time, stress, and money. By following this tax receipt checklist, you’ll be well on your way to mastering your financial records.

Ready to take control of your expenses and streamline your tax preparation? Try Portmoneo for free and discover how easy it can be to capture, categorize, and export your receipts for taxes. Start tracking smarter today and experience the peace of mind that comes with impeccable financial organization!

FAQ: People Also Ask About Self-Employed Tax Receipts

Q: Can I use a credit card statement as a receipt for tax purposes?

A: Generally, no. While a credit card statement proves payment, it often lacks the itemized details (what was purchased, tax breakdown) required by tax authorities to substantiate a business expense. Always strive to obtain the original itemized receipt.

Q: What if I lose a business receipt? Can I still claim the expense?

A: If you lose a receipt, you might still be able to claim the expense if you have other reliable records, such as bank statements, credit card statements, or invoices, that clearly show the amount, date, and business purpose. Keep detailed notes about why the original receipt is unavailable.

Q: Are all business meals 100% deductible for self-employed individuals?

A: No, generally, only 50% of the cost of business meals is deductible. The meal must be an ordinary and necessary business expense, not lavish or extravagant, and you (or an employee) must be present. Always record the business purpose and attendees.

Q: Should I keep both digital and physical copies of my receipts?

A: While most tax authorities accept legible digital copies, keeping physical copies of especially important or high-value receipts for a short period after digitization can provide an extra layer of security. However, for most transactions, a well-managed digital system is sufficient and often preferred.

Q: How does Portmoneo help with self-employed tax receipts?

A: Portmoneo simplifies tax receipt management by allowing you to easily scan and capture receipts using your phone, automatically categorizing expenses, adding custom notes, and securely storing digital copies. It also enables quick export of organized data for your accountant, streamlining your tax preparation process.