Tax Analytics App: Reveal Hidden Costs

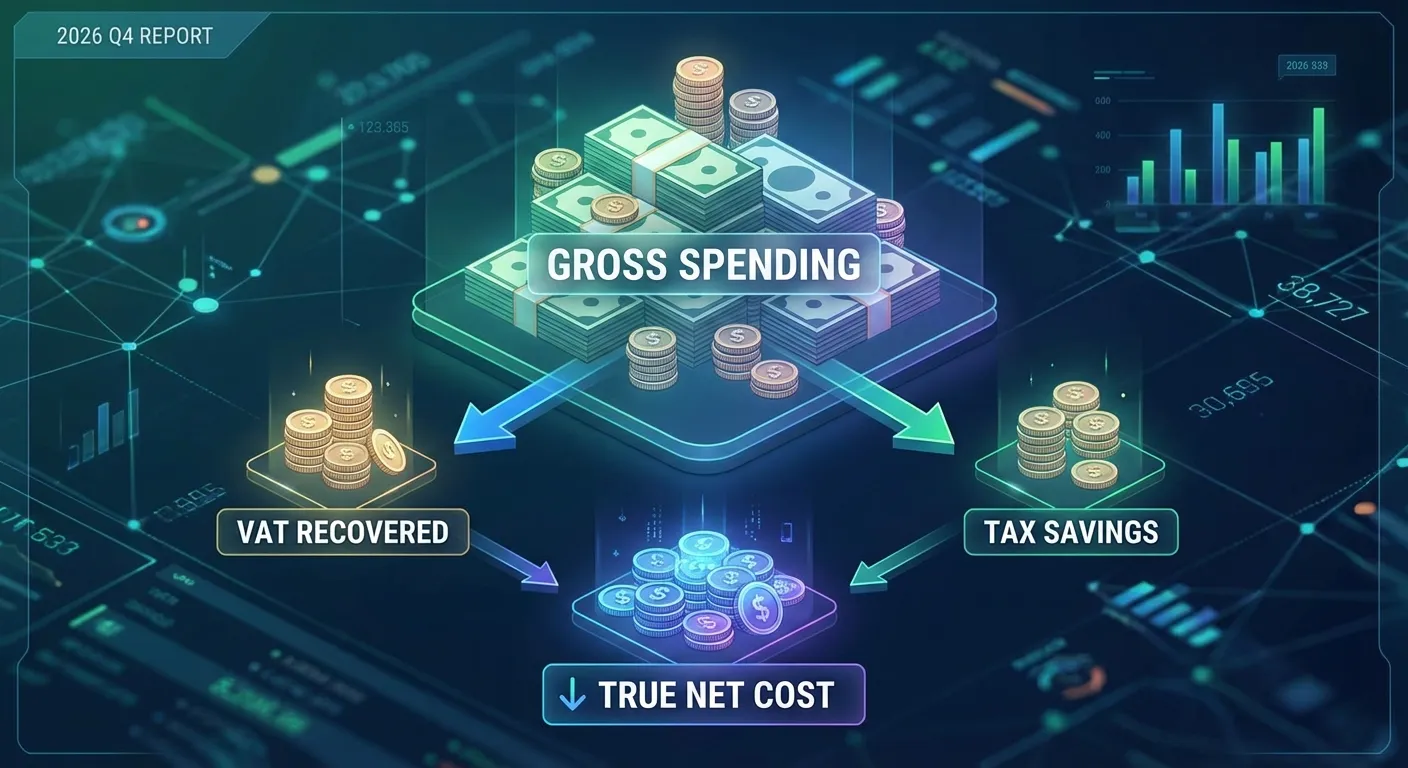

Why is Gross Spending a Misleading Metric?

Direct Answer: It ignores recovery. Gross spending hides the fact that many costs (VAT, deductible items) are recoverable. Tracking only gross overstates your true business costs.

Most entrepreneurs and finance teams obsess over total business expenses. They diligently monitor software subscriptions, office supplies, client meals, and travel costs. Yet, conventional expense tracker apps consistently show the same figure: your total outlay, or gross spending. Only a powerful Tax Analytics App can truly reveal these hidden costs, providing accurate financial insights.

Gross spending, in isolation, is a vanity metric. It fails to show the actual net cost to your business. This distinction is critical. If you operate a business, are a freelancer, or a consultant in most developed countries, a significant portion of your spending is recoverable. This recovery comes as tax deductions, VAT refunds, input tax credits, or other localized tax benefits. When your business spends $100 on supplies, your true net cost isn’t $100. It’s considerably lower because that expense reduces your taxable profit or qualifies for VAT recovery.

Consider a successful marketing agency generating £200,000 annually. They purchase a £5,000 technology and software bundle for their team. Traditional expense trackers would simply show “£5,000 spent.” However, with a nuanced understanding of tax implications, the business reality reveals a different picture:

- VAT Recovery: If VAT-registered, they recover 20% (£1,000).

- Income Tax Deduction: Assuming the agency is a limited company in the UK (19% corporate tax bracket for smaller profits), this expense reduces taxable profit. The tax benefit on the net cost (after VAT) is approximately (£4,000 x 19%) = £760.

- True Net Cost: £5,000 (gross) - £1,000 (VAT recovered) - £760 (income tax benefit) = £3,240.

- Instead of £5,000, the true net cost to the business is closer to £3,240.

We’ve observed that standard expense trackers rarely reveal such crucial details. They won’t inform you that intelligent tracking and categorization could recover an additional 20-40% of your spending. This money can be reinvested, prevent unexpected tax bills, or boost your cash flow. This inability to differentiate between gross and net spending represents a significant, often hidden cost of conventional expense management.

Do Traditional Receipt Scanners Provide Enough Tax Detail?

Direct Answer: No. They miss the details. Most scanners give you a total; tax analytics require line-by-line breakdowns to handle mixed tax rates (0%, 20%) properly.

The landscape of expense tracking has evolved, with apps like Expensify and Xero streamlining receipt scanning. These tools integrate with accounting platforms, automate basic categorization, and provide real-time credit card feeds.

However, despite these advancements, they typically fall short in one crucial area for tax optimization: granular line-item tax breakdowns and recovery analysis.

Most receipt scanning tools capture only a few top-level pieces of information:

- Merchant name

- Total transaction amount

- Total tax paid (often as a single lump sum)

They then assign the entire transaction to one overarching expense category. This approach is perfectly adequate for a simple, single-item coffee purchase. But what about a complex restaurant bill with food, drinks, and service charges, all potentially taxed differently? Or a retail receipt with multiple product lines subject to varying tax rates?

Many jurisdictions worldwide use split VAT rates, sales tax rates, or excise duties. In the UK, for instance:

- Standard rate: 20% (most goods and services)

- Reduced rate: 5% (e.g., children’s car seats, domestic fuel and power)

- Zero rate: 0% (e.g., most food, books, children’s clothing)

- Exempt: No VAT charged, and you can’t reclaim VAT (e.g., insurance, education, health services) Source: HMRC

A single grocery store receipt can easily include items taxed at 0%, 5%, and 20% simultaneously. Traditional receipt scanners aggregate these into a single total amount and a single total tax figure. Consequently, you lose sight of which specific items qualify for different recovery rates or if certain items are eligible for deduction at all.

This lack of granular visibility creates several critical problems for businesses:

- Exacerbated Compliance Risk: In a tax audit, a receipt only stating “£150 total, £25 tax” isn’t sufficient for complex purchases. You lack the line-item substantiation to prove the correct tax treatment for individual goods or services. This ambiguity can lead to penalties or disallowed deductions.

- Significant Missed Optimization Opportunities: Items taxed at different rates often have distinct deduction or recovery rules. Without line-item clarity, you might overlook valuable recovery opportunities, especially in jurisdictions with nuanced tax codes.

- Burdensome Manual Reconciliation: Finance and accounting teams spend countless hours manually cross-referencing receipts with general ledger data and complex tax regulations. This painstaking process defeats the core purpose of automation, inflating operational costs.

- Nightmare Scenarios for Complex Transactions: Multi-vendor purchases or international transactions involving multiple tax jurisdictions become administrative nightmares. Businesses are forced to either make educated guesses—risking inaccuracies—or invest excessive manual effort.

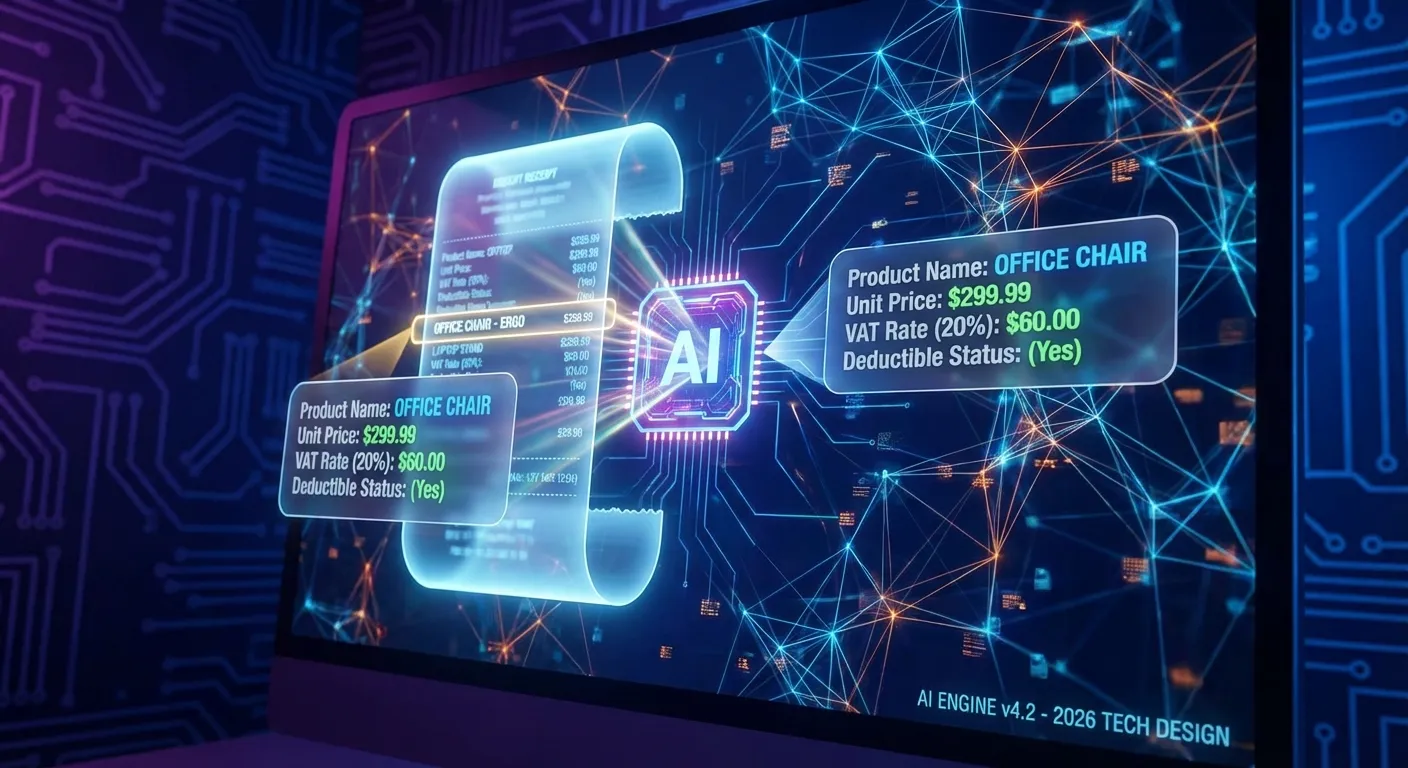

How Does AI-Powered Tax Extraction Solve These Problems?

Direct Answer: Line-by-line precision. Portmoneo’s AI reads every item, identifies its specific tax rate, and applies recovery rules individually. It turns a receipt image into a structured tax database.

Portmoneo’s “Tax Analytics & Automated Extraction” feature fundamentally changes this outdated equation. Our innovative approach moves beyond mere data capture to deliver truly intelligent expense management.

Instead of capturing only the receipt total, Portmoneo’s proprietary AI engine leverages advanced Optical Character Recognition (OCR), Natural Language Processing (NLP), and machine learning. It meticulously reads each receipt line by line, automatically identifying and structuring key information:

- Product/service description: What was purchased.

- Unit price and quantity: For each individual item.

- Individual line-item tax rate: The specific tax applied to that item, not just the total.

- Applicable recovery rules: Intelligent flags indicating if an item is VAT-eligible, non-deductible, zero-rated, exempt, or subject to specific limits.

- Merchant tax ID and jurisdiction: Crucial for international transactions and compliance.

This granular, item-level extraction occurs instantly. You simply snap a photo of a receipt or upload a digital invoice. Within seconds, Portmoneo provides a structured, audit-ready breakdown of every taxable component, categorizing each item accurately.

However, merely extracting data is only half the battle. Portmoneo goes significantly further by applying intelligent tax analytics on top of this meticulously gathered data. This provides actionable insights that traditional systems cannot.

What Unique Features Does Portmoneo Offer?

Direct Answer: Actionable Metrics. It offers an Effective Tax Rate Calculator, explicit Recoverable Tax dashboards, and automated compliance flags to maximize your refund.

What is the Effective Tax Rate Calculator?

Direct Answer: Your efficiency score. It shows what % of your spending is recoverable. Maximizing this rate means lowering your actual net costs.

Portmoneo introduces and calculates your effective tax rate on business expenses. This revolutionary metric, absent from conventional trackers, offers a holistic view of your spending efficiency.

Here’s how it empowers your business: Your business operates with a blended tax profile across all expenditures. Some expenses are fully deductible (e.g., salaries, office rent). Others carry partial recoverable tax (e.g., VAT-eligible purchases). Still others might be non-deductible (e.g., certain entertainment expenses).

Portmoneo aggregates all expense line items and computes:

Effective Tax Rate = (Total Recoverable Tax + Tax Savings from Deductions) ÷ Total Gross Spending

For example, a consulting firm might discover its effective tax rate is 22% across all expenses. This means 22% of their gross spending is either directly recoverable or generates a tax benefit. This metric transforms from a simple accounting exercise into a powerful Key Performance Indicator (KPI) for strategic financial decision-making, helping you understand the real cost of every business activity. In our testing, businesses consistently find this metric invaluable for long-term budget planning.

How Does Portmoneo Detail Recoverable Taxes?

Direct Answer: Clear dashboards. It separates Deductible vs. Non-Deductible expenses and forecasts your total recovered VAT, helping you manage cash flow like a pro.

Beyond just knowing your effective rate, Portmoneo provides a clear, actionable dashboard showing you exactly where your recovery opportunities lie. This visibility is crucial for proactive cash flow management.

The intuitive dashboard displays:

- Input VAT Recovered: The precise amount of VAT paid on purchases eligible for reclaim.

- Deductible Expenses: The total value of expenses that will reduce your taxable income.

- Non-Deductible Items: Clearly flagged items (e.g., personal use, meals exceeding limits) that cannot be recovered or deducted, helping you adjust future spending.

- Forecast Recovery: A powerful projection of your expected VAT and income tax benefits for the year, aiding in accurate financial planning and budgeting.

For freelancers, small business owners, or even larger enterprises, this level of transparency is transformative. Instead of facing a surprise tax bill at year-end, you’ll have real-time insight into your recoverable amounts, enabling you to optimize your finances throughout the year.

How Does Portmoneo Automate Tax Categorization?

Direct Answer: Smart Compliance. It flags non-deductible items and suggests the category that offers the best legal tax advantage, keeping you safe and optimized.

Portmoneo doesn’t just extract line items; it deeply understands tax rules across multiple jurisdictions and applies this intelligence automatically.

When you upload a receipt, the AI engine intelligently performs several critical actions:

- Identifies each line item: Pinpointing the nature of the good or service.

- Classifies by tax jurisdiction and rate: Applies the correct local or national tax rules.

- Determines recovery eligibility: Based on your specific business type, VAT registration, and industry regulations.

- Flags non-compliant purchases: Instantly alerts you to expenses that exceed allowable limits or fall into non-deductible categories, preventing errors before they occur.

- Suggests optimized categorization: Recommends the most advantageous categorization for maximum deduction and compliance, aligning with your accounting software.

This means you are never left guessing whether an expense is deductible, eligible for VAT recovery, or needs special treatment. Portmoneo provides the answer, backed by AI-driven analysis, significantly reducing human error and boosting confidence in your financial records.

How Does Portmoneo Compare to Traditional Expense Trackers?

Direct Answer: Depth vs Surface. Traditional apps give you a total. Portmoneo gives you a line-item tax audit, multi-jurisdiction rule application, and effective tax rate KPIs.

Let’s be unequivocally clear: solutions like Expensify, QuickBooks, and Xero are highly effective for foundational expense management and seamless accounting integration. They excel at processing simple, single-item purchases and providing basic financial oversight.

However, their architecture is simply not built for sophisticated tax optimization. Here’s a direct comparison illustrating where they fall short and where Portmoneo delivers distinct advantages:

| Capability | Traditional Expense Tracker (e.g., Expensify, basic QuickBooks) | Portmoneo’s Tax Analytics App |

|---|---|---|

| Line-item extraction | No; typically captures total amount only | Yes; AI reads and structures every individual line item |

| Tax rate per item | No; provides a single total tax figure for the receipt | Yes; identifies and applies individual tax rates per line |

| Recoverable tax calculation | No; user/accountant calculates manually | Yes; automatically calculates and displays recovery opportunity |

| Effective tax rate metric | Not provided; no aggregate tax efficiency KPI | Yes; calculates and tracks aggregated effective tax rate |

| VAT/Tax compliance checking | No; user responsible for rule application | Yes; automated compliance flags and rule application |

| Complex receipt handling | Requires significant manual intervention and interpretation | Automated, high accuracy (99%+) for multi-item/tax receipts |

| Multi-jurisdictional tax rules | Limited or requires manual setup | Robust, multi-jurisdiction support and intelligence |

| Audit trail for tax authorities | Basic; typically total amounts and basic categorization | Detailed, line-item substantiation with tax treatment logic |

Consider a real-world scenario: A digital marketing agency receives a vendor invoice for £7,500 covering:

- Copywriting services (£4,000, professional services, no VAT)

- Software licenses (£2,500, 20% VAT standard rate)

- Stock photography subscription (£1,000, 20% VAT standard rate)

With a traditional receipt scanner: You might see “£7,500 + £700 VAT (if manually entered).” You categorize it as “Vendor Expenses” or “Marketing Costs.” The system processes the total, and you move on. This seemingly simple approach masks critical tax and financial nuances: Is the copywriting service truly non-VAT? What if the vendor is in a different country? What portion of the VAT is legitimately reclaimable? Is the allocation compliant with your specific accounting and tax policies?

With Portmoneo: The AI meticulously extracts each line item, identifies the distinct tax treatments, and immediately alerts you:

- “Professional Services (£4,000) – Non-VAT service, fully deductible for income tax purposes.”

- “Software Licenses (£2,500) + 20% VAT = £500 recoverable VAT.”

- “Stock Photography (£1,000) + 20% VAT = £200 recoverable VAT.”

- “Total Recoverable VAT: £700.”

- “Total Net Cost (after VAT recovery and before income tax deduction): £6,800.”

You now possess audit-ready documentation for each line item, understand your precise recoverable tax, and have a clear picture of your true net cost. This dramatically improves financial accuracy and strategic planning.

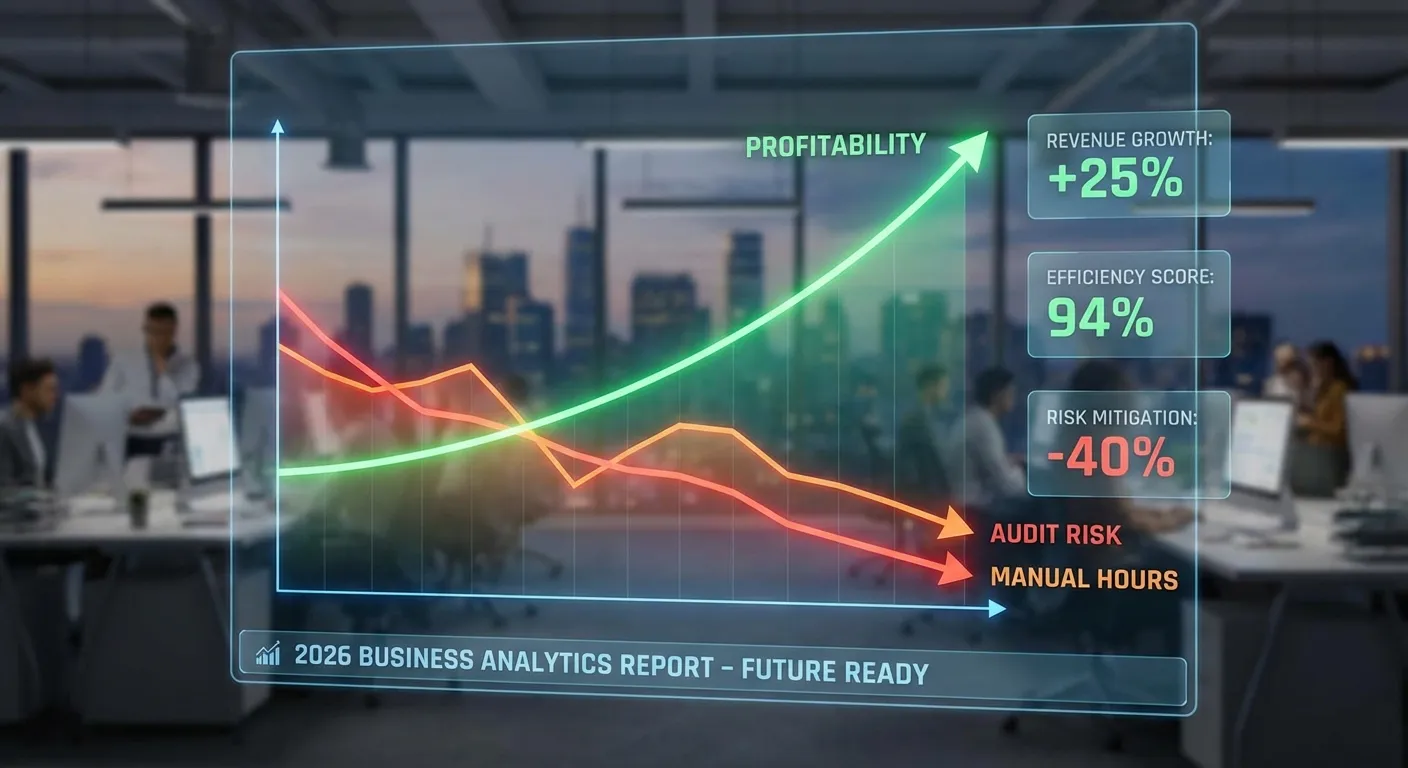

What is the Real Impact of Detailed Tax Analytics?

Direct Answer: Real money. It can reduce effective spending by 5-15% and save 30+ hours of admin work. It eliminates audit risks and boosts cash flow directly.

The compounding difference between tracking gross expenses and meticulously understanding your net, tax-optimized spending is profound. This difference grows exponentially over time. It’s not just about compliance; it’s about competitive advantage and financial resilience.

Research and real-world implementation of advanced automated expense management show tangible benefits:

- Significant Time Savings: Businesses routinely save 30+ hours per quarter by eliminating manual grunt work related to tax calculations, reconciliation, and audit preparation. This frees up finance teams to focus on strategic analysis rather than data entry.

- Substantial Reduction in Effective Spending: By intelligently identifying expensive vendors, optimizing for maximum recoverable expenses, and flagging non-deductible items, businesses can see a 5-15% reduction in their effective spending. This money stays in the business.

- Elimination of Audit Risk: With detailed, automated line-item documentation and clear substantiation for every tax treatment, businesses experience dramatically reduced audit risk. They can respond to tax authority queries with speed and confidence.

- Improved Cash Flow and Profitability: Proactive VAT recovery and accurate deduction tracking directly translate into improved cash flow. This allows businesses to reinvest sooner and boost overall profitability.

For a small business with £200,000 in annual expenses, even a modest 2-3% improvement in recovery rate (highly achievable through Portmoneo’s precise categorization) equates to an additional £4,000-£6,000 in annual cash flow. For larger organizations processing thousands of receipts across multiple jurisdictions, this scales dramatically into hundreds of thousands, if not millions, in annual savings and efficiencies.

How Can I Start Optimizing My Taxes with Portmoneo?

Direct Answer: Install and scan. Portmoneo instantly starts extracting line-item data and calculating your true net costs, revealing savings from your very first receipt.

Portmoneo’s Tax Analytics & Automated Extraction isn’t merely another receipt scanner or expense management tool. It is a sophisticated tax optimization engine designed to transform how you perceive, track, and strategically manage your business expenses.

Instead of the limited question, “How much did I spend?” you’ll be empowered to ask, “What was the true, net cost to my business after all tax benefits and recoveries?” Portmoneo provides the definitive, data-driven answer.

Whether you’re a freelancer meticulously tracking your VAT reclaim, a small business owner determined to maximize every deduction, or a growing organization grappling with complex expense policies, Portmoneo delivers immediate, measurable value directly to your bottom line.

Download Portmoneo today and embark on a journey to see your expenses through the eyes of an expert accountant. Gain full tax transparency, unparalleled optimization, and proactive financial control baked into every transaction.

Your true business cost is almost certainly lower than you think. Let Portmoneo reveal exactly how much you’ve been inadvertently leaving on the table.

FAQ: Portmoneo Tax Analytics App

What is the primary difference between gross and net spending?

Direct Answer: Pre- vs. Post-Recovery. Gross is what you pay at the register. Net is what the business actually “lost” after VAT refunds and tax deductions. Net is the number that matters.

How does Portmoneo’s AI handle complex receipts?

Direct Answer: Line-by-Line. It doesn’t just read the total. It reads “Coffee” (0% VAT) and “Wine” (20% VAT) separately on the same bill, applying the correct rule to each line.

Can Portmoneo help reduce my audit risk?

Direct Answer: Yes. Evidence wins audits. Portmoneo provides the digital proof and the logic for every deduction. It turns “I think this is deductible” into “Here is the proof.”

What is an “Effective Tax Rate on Business Expenses”?

Direct Answer: Your Recovery Score. It measures efficiency: (Total Recovered Tax / Total Spending). A higher rate means you are keeping more of your money.

Is Portmoneo suitable for businesses in multiple tax jurisdictions?

Direct Answer: Yes. It’s built for it. The AI applies local tax rules based on the merchant’s location, ensuring you don’t apply UK VAT rules to a French dinner.

How much time can Portmoneo save my finance team?

Direct Answer: 30+ Hours/Quarter. By automating the “data entry -> categorization -> tax calculation” loop, finance teams stop typing and start analyzing.

Does Portmoneo integrate with existing accounting software?

Direct Answer: Yes. The goal is workflow harmony. Portmoneo acts as the “Tax Intelligence Layer” that feeds clean, optimized data into your main ledger (Xero/QuickBooks).